At The Falkirk Business Club breakfast roundtable this morning we discussed the risk of coronavirus on businesses, and what steps we should take as small business leaders to manage the threat.

So first question – is it a threat? Isn’t it just hysteria? And if it is a genuine threat, I just run a small business – so what can I do anyway?

If these questions resonate with you – then read on.

First question: Is it a threat? Well – yes. None of us know exactly how far it will spread and the impact it will have, but it is certainly a threat. And just by being a threat it is already negatively impacting business – one of our members reported they have already lost some contracts directly due to coronavirus.

As it is impossible to predict exactly what will happen, let me use the Chief Medical Officer as my guide. Chris Whitty has suggested a UK epidemic is “likely” with up to 80% of the population being infected at some point (a “reasonable worst case scenario”). Before we start building the barricades – based on China’s experience the majority (80%) of those infected will be no worse than with the common cold, but c. 20% of those infected will become ill, and it could be fatal for around 1% of those who contract it.

At peak this could mean up to 20% of the workforce being off ill, with the peak likely to last a few weeks, and the peak most likely to occur in 2-3 months’ time.

Just as important – and impactful to business – is the potential (or likely) steps the Government may take to slow it down and reduce it, such as school closures and restricted travel. Businesses may well be asked to impose home working to reduce contact. All these steps will clearly have an impact on us all.

So back to question 1: Yes! It is a threat and it will impact us all – whether it is contained or not. So let’s move on to question 2: I just run a small business, so what can I do anyway? Well, we can all take steps – this is now into Risk Management.

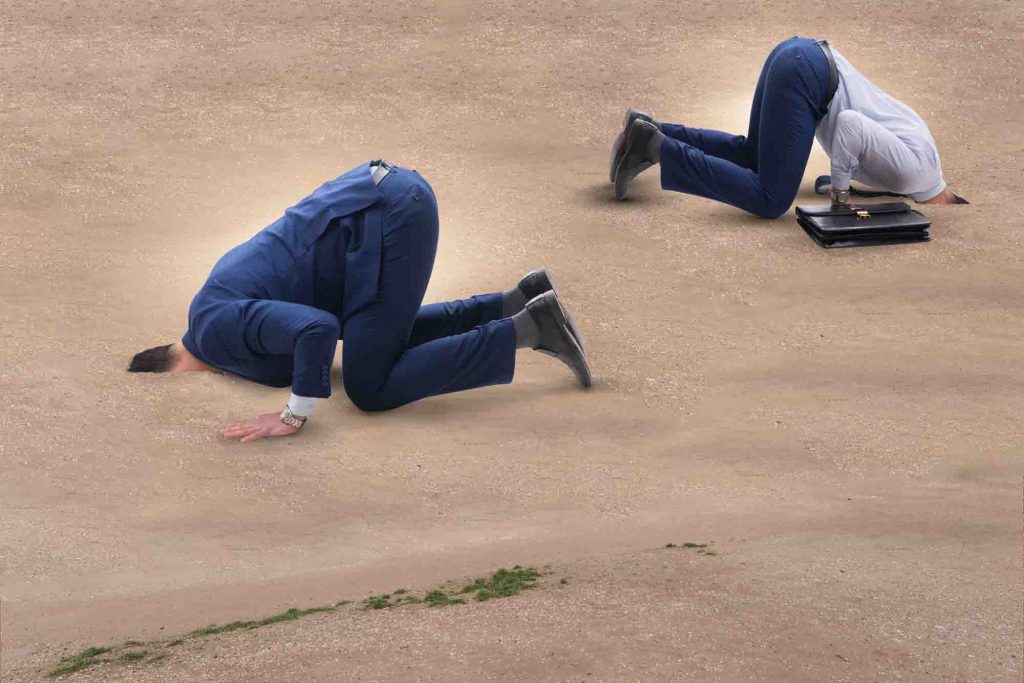

Risk Management is something which can be difficult to do – and particularly so for small businesses… unfortunately often the default position can be ‘ignore and hope for the best’.

Sadly, small businesses are always more at risk from such events – their balance sheet to see them through turbulent times is smaller, they can suffer greater immediate impact to loss of sales, and are more reliant on their workforce and key persons in particular. Some small businesses will fail because of coronavirus.

I listened to one small business owner on the radio yesterday. They run Childrens’ Events and they are already being asked to stop events and having bookings cancelled. They believe this will be terminal for their business. Think also about Travel Companies who have already been going through difficult times – how many of these will this put at risk of closure?

As with all major market risks, the first aim must be survival: how do we ensure we come through this still solvent. Secondly we have a duty of care for staff and customers.

What are the main risks?

We did a quick brainstorm this morning and came up with the following 4 main risks for businesses (and these are relevant for all businesses, from a one-person band to multi-national corporation):

- Market downturn / loss of sales

- Staff members infected

- Delays to Global Supply Chain

- Government imposed restrictions / shut-down

Of course there are more, but we stuck with these four as the most significant.

Market downturn is self-explanatory, and I have already shared some examples of loss of sales. People will go out less, shop less, cancel events. This will impact some businesses more than others. But these businesses to protect themselves will in turn cancel contracts they have, and so on – therefore most businesses will suffer an impact to sales from coronavirus.

Coronavirus: Eight charts on how it has shaken economies.

Staff members will be infected. You may have many members of your team off at the same time. You may become ill. Many small businesses are just one or two people, and when you are ill your business may halt (reverting to the loss of sales risk above).

Where are your suppliers based? So much is manufactured in China, and China has been on lock-down (see the ‘Eight charts’ article above). Even if your suppliers are in Europe, where are their suppliers based? Even if you are a services business and don’t have suppliers – what about your customers? If their supply chain breaks down, then their trading slows down, and they may pause or cease their support from you (reverting to loss of sales risk again too).

Government restrictions. The Government has rightly drawn up plans. We are currently in their ‘contain’ phase, but according to Chris Whitty the government is now “on the borderline between containing and delaying”. Steps in delaying include school closures and instructions to work from home.

So if these are the risks – what can we do? Without going into the theory of risk mitigation approaches, at Ahead Business Consulting we adopt the standard four: Avoid, Reduce, Transfer and Accept.

Given the nature of this threat is uncontrollable, ‘Avoid’ is not really possible, so we are mainly looking at ways to ‘Reduce’. For us in small business this means taking steps to reduce catching the virus, but in the most part this is forward thinking and planning to deal with the potential or likely scenarios that may occur, and what steps we can take to keep our business going. Let us help you out…

Risk mitigation approaches for businesses:

Market Downturn. Assume loss of sales. Hopefully you will have a Business Plan already and know your critical failure points, and have effective KPIs which track these. If you don’t – do this now! [Fortunately for our Business Club members we covered business plans last month.] What happens if you lost 20% of sales for a quarter? What about 50% for 6 months? And, if either of these happened, what steps can you take to protect your business? Can you bring some payments forward, extend an overdraft, delay some supplier payments, reduce unnecessary spend, close out bad debt / late payments?

Staff members infected. First up – try to minimise by following government guidelines. The main thing is regular washing of hands, and avoid touching your face – establish processes for your staff to encourage this. Reduce or stop unnecessary travel. Be aware of any staff travelling internationally outside of work – particularly to high-risk countries such as China, Japan, South Korea, Iran, Syria or Italy – Italy clearly being the most likely from UK. If a staff member does have to travel, can you isolate them for two weeks on return to reduce risk of affecting the rest of your staff?

Self-isolation has itself created a raging debate over whether staff should receive sick-pay or not. Government guidelines if you exhibit symptoms is don’t go to your GP (and infect others), but self-isolate for 14 days – however technically you can only get sick-pay over 5 days with a doctor’s note. The government has just announced today that statutory sick-pay will be paid from the 1st day off (not day 4) – but in reality as a business owner, you don’t want potentially sick members infecting the rest of your staff, so paying them for self-isolation is both morally and commercially the right thing to do.

Coronavirus: Three days more sick pay for self-isolating workers.

Secondly if 20% or more of your workforce is down at the same time – how would your business cope? Plan for this scenario – we call this ‘Business Continuity’. Identify the most critical elements of your business that must be continued, and do them first (generally anything that directly impacts or benefits your customers, and mandatory requirements) – park what you can until later.

Business Continuity Planning (BCP).

The same applies to Government Restrictions. If we got put on lockdown to cease travel, what can you do to continue to operate your business? Unless you are directly customer facing (such as retail, hospitality, trades) then many of your team may work in an office. Make sure you get the team enabled for remote working – this will also be needed if schools are closed and parents need to work from home to look after children; for self-isolation; or the 80% of infected staff who are not badly ill, but should avoid infecting others. One of the key components of Business Continuity Plans is ensuring an effective communication cascade, and testing it out. So if you haven’t got a plan, make one NOW (in the next week), and test it straight-away (and learn from the test, adjusting your plan as you need). That way you know you are protected and can still function as a business should the worst-case shutdown take place.

Supply chain again requires thought and planning. If you rely on suppliers, engage with them now to understand their chains and their mitigations (How much stock do they carry / how long will it last? Do they have an alternative source if a country is embargoed? Will time or price be affected?). Better to know now and plan, than find out when it happens. Check out alternative suppliers (asking them the same questions). Does your cashflow allow you to increase your own stock levels now? If you are a service company, then the risk is more back to loss of sales if your clients are forced to slow down.

In addition to ‘Reduce’ there is also ‘Transfer’. More often than not this refers to insurance. So check yours out. If your business were shut down for a month due to government restrictions are you covered? What about ‘Business Interruption and Supply Chain’ cover? Or ‘Key Person Insurance’ (also known as ‘key man’)? If you are heavily reliant on one individual and they were incapacitated for a period of time (or worse) – are you covered? Understand your current insurance protection and take out other cover if you need it to protect your business.

AND, FINALLY…

… think of opportunities. And whilst people will always take advantage of such crises to profiteer from selling face-masks and the like – I am not talking about this. Think about your customers in the same way as you have considered your own business, and the impacts to them. What challenges will they be facing from this crisis that you might be able to help them with?

If you have greater cash reserves, can you offer to defer their payments to you if they might be more impacted? What else might your business be able to offer to help them mitigate their risks?

Goodwill goes a long way in relationships so those who help out will be remembered and appreciated – and better to get paid later than not at all if the alternative is they go out of business or you are one of the services they are forced to cease.

So to recap. Coronavirus will impact the business market heavily. Some businesses will fail. Don’t bury your head in the sand – consider the potential risks and make plans NOW. Protect your business as best you can, and do what you can to help others survive too. Together we will succeed.