Businesses to benefit from increased R&D Government funding: Chancellor’s 2020 Budget

Jeff Drennan, Managing Partner at Amplifi Solutions, comments of the changes in R&D support and the R&D tax credit scheme as outlined in the Chancellor’s 2020 budget:

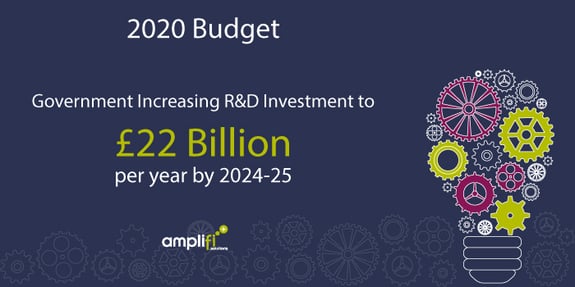

“Today, Chancellor Rishi Sunak has announced that the Government’s investment in R&D will increase to £22 billion per year by 2024-25 – up from the Conservative party’s manifesto pledge to increase investment to £18 billion. This represents the largest increase in R&D spend ever announced from a new budget.”

“Expenditure credit (RDEC) for large companies on the R&D tax credit scheme will also increase from 12% to 13% – effective from 01 April 2020. This is much welcomed news for large companies who are embarking on increased R&D expenditure in the coming months and will no doubt encourage additional financial investment.

Of particular interest to Edinburgh Connections members will be that SME companies will also continue benefit from R&D Tax Credits, allowing them deduct an extra 130% of their qualifying costs from any profits, on top of the existing 100% of qualifying costs that can usually be deducted – a total potential deduction of 230%”. A very welcome boost to cash flow, especially during these difficult times.

“The Chancellor also pledged in the 2020 budget to examine how the R&D benefit is distributed across the United Kingdom to help level up every region.”

“The Government will also consult on widening the definition of R&D to include cloud computing and data fall. This commitment is most welcome, as it ensures that the legislation becomes more relevant to current technologies and that companies are able to make full use of the relief for even more types of innovation.”

Amplifi Solutions, whose team includes Management and Chartered Accountants, provides an end-to-end specialist technical service that takes companies throughout the entire R&D process – from an initial and free exploratory meeting, creation of the R&D claim, and submission to HMRC – all to you receiving the R&D tax benefit.

Remember that R&D tax credits can be awarded to any company proving they are seeing a problem or a gap in the market and starts investigating different ways to fill it. They could end up trying to create a new product, change a process or even extend the knowledge within a certain field. This is R&D. The tax breaks were introduced in 2000 by the Government to encourage and reward R&D within limited companies or PLCs.

For more information on R&D tax credits contact our team or contact Grant Laing on glaing@amplifi.solutions